All Categories

Featured

Table of Contents

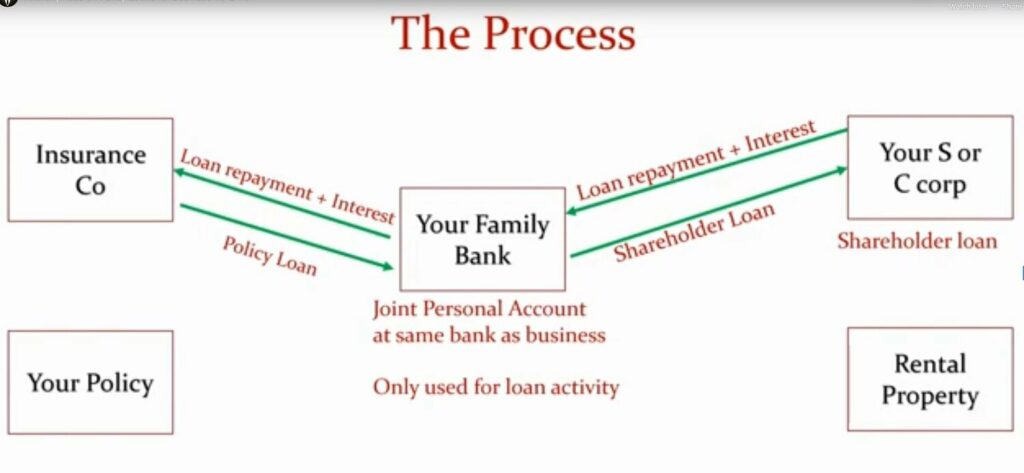

The settlements that would have or else gone to a banking organization are paid back to your personal pool that would certainly have been made use of. More cash goes right into your system, and each buck is carrying out several jobs.

This money can be utilized tax-free. The cash you utilize can be paid back at your recreation with no collection repayment schedule.

This is just how family members pass on systems of wealth that enable the following generation to follow their desires, begin services, and capitalize on chances without losing it all to estate and inheritance tax obligations. Companies and financial institutions use this method to create working pools of resources for their companies.

Infinite Banking In Life Insurance

Walt Disney used this technique to start his imagine developing an amusement park for youngsters. We would certainly love to share extra examples. The inquiry is, what do want? Comfort? Economic protection? An audio financial service that doesn't depend on a changing market? To have cash money for emergency situations and opportunities? To have something to pass on to individuals you love? Are you happy to find out more? Financial Preparation Has Failed.

Join among our webinars, or attend an IBC boot camp, all for free. At no price to you, we will teach you much more regarding exactly how IBC functions, and develop with you a strategy that works to resolve your problem. There is no obligation at any kind of factor in the process.

This is life. This is tradition.

It appears like the name of this principle changes as soon as a month. You might have heard it described as a perpetual riches method, family banking, or circle of wide range. No matter what name it's called, unlimited banking is pitched as a secret method to build wide range that only rich people find out about.

How do interest rates affect Financial Leverage With Infinite Banking?

You, the insurance holder, placed money into a whole life insurance policy plan with paying costs and buying paid-up enhancements. This increases the cash money value of the policy, which indicates there is more money for the reward rate to be applied to, which generally indicates a higher rate of return overall. Dividend rates at significant suppliers are presently around 5% to 6%.

The entire concept of "banking on yourself" only functions due to the fact that you can "bank" on yourself by taking fundings from the policy (the arrow in the graph above going from entire life insurance coverage back to the insurance holder). There are two different sorts of lendings the insurer may offer, either direct recognition or non-direct acknowledgment.

One function called "clean loans" sets the rate of interest rate on loans to the very same price as the reward price. This implies you can obtain from the policy without paying passion or receiving interest on the quantity you borrow. The draw of infinite banking is a returns rates of interest and guaranteed minimum rate of return.

The downsides of limitless banking are often overlooked or otherwise stated at all (much of the details readily available concerning this concept is from insurance coverage representatives, which may be a little prejudiced). Only the money value is expanding at the reward price. You also need to pay for the price of insurance policy, fees, and expenses.

Who can help me set up Policy Loans?

Every long-term life insurance policy is various, however it's clear someone's overall return on every dollar invested on an insurance coverage product might not be anywhere close to the reward rate for the plan.

To give a really basic and theoretical instance, let's presume a person is able to gain 3%, on standard, for every single dollar they invest in an "limitless financial" insurance policy product (besides expenses and costs). This is double the estimated return of whole life insurance coverage from Consumer Reports of 1.5%. If we presume those dollars would undergo 50% in taxes total otherwise in the insurance coverage item, the tax-adjusted price of return can be 4.5%.

We assume greater than typical returns on the entire life item and a really high tax obligation rate on bucks not place into the plan (which makes the insurance product look much better). The reality for many people might be even worse. This pales in comparison to the long-lasting return of the S&P 500 of over 10%.

How do interest rates affect Infinite Banking For Retirement?

Limitless financial is a wonderful product for agents that offer insurance, but may not be optimum when compared to the more affordable options (without sales individuals earning fat commissions). Here's a malfunction of some of the other supposed benefits of limitless financial and why they may not be all they're fractured up to be.

At the end of the day you are purchasing an insurance item. We love the defense that insurance policy uses, which can be gotten much less expensively from a low-cost term life insurance policy. Overdue financings from the plan might additionally lower your fatality benefit, diminishing one more level of defense in the plan.

The idea just functions when you not just pay the substantial costs, however make use of additional cash money to acquire paid-up enhancements. The opportunity price of every one of those dollars is tremendous very so when you could instead be purchasing a Roth Individual Retirement Account, HSA, or 401(k). Also when contrasted to a taxed financial investment account and even an interest-bearing account, unlimited financial may not offer similar returns (compared to investing) and equivalent liquidity, gain access to, and low/no charge structure (contrasted to a high-yield savings account).

Lots of individuals have actually never listened to of Infinite Banking. Infinite Banking is a means to handle your money in which you create a personal financial institution that functions just like a normal bank. What does that suggest?

How do I qualify for Infinite Banking Retirement Strategy?

Simply put, you're doing the financial, yet instead of depending on the standard financial institution, you have your own system and complete control.

In today's article, we'll show you 4 different means to make use of Infinite Financial in company. We'll go over 6 means you can make use of Infinite Banking directly.

Latest Posts

How To Use Whole Life Insurance As A Bank

How To Be Your Own Bank - Simply Explained - Chris Naugle

Using Your Life Insurance As A Bank